Over 2 million members

have invested in their future with OneFamily

What are lifetime ISAs?

OneFamily’s Lifetime ISA is a type of investment account designed to help you buy your first home sooner or save extra for retirement.

You can invest up to £4,000 a year and the government will give you 25% on top of everything you pay in. So, you can get up to an extra £1,000 a year towards your first home or retirement!

You can open a OneFamily Lifetime ISA with a minimum £25 a month direct debit or a lump sum of at least £250.

Lifetime ISAs are available for UK tax residents aged between 18 and 39. You can pay into the account until you turn 50.

If you withdraw your money before you turn 60 for anything other than buying a first home (worth no more than £450,000), you’ll be charged a 25% government penalty which may leave you with less than you’ve paid in.

Our Lifetime ISA invests in stocks and shares, the value of which can go up and down so you may get back less than you put in.

Lifetime ISA calculator

How soon can you buy a house with a OneFamily Lifetime ISA?

This projection shows how your lifetime ISA could grow with low, medium and high performance. Remember, projections are not a guarantee of future performance and you could get back less than you pay in.

Please note: No more than £4,000 may be invested into a Lifetime ISA within a single tax year. This includes your initial investment and your monthly direct debit payments.

How does a lifetime ISA work?

Open your lifetime ISA and choose which of our two ready-made funds you'd like to invest in.

Work out how soon you want to buy your home and set up a direct debit that will make your goal a reality.

Every month, get an extra 25% of everything you paid in the month before from the government. You can pay in up to £4,000 a year, so there’s £1,000 bonus available.

When it’s time to buy your first home, simply tell your solicitor that you’re using a OneFamily Lifetime ISA. We'll send them the money.

More fund choice is coming soon

We’re always looking for ways to improve our funds and help our members get the best return on their investments. As part of this, we’re currently working on some improvements that you’ll see in the next couple of months. This will make things better for all our customers, both new and existing.

There won’t be any changes to the level of risk of the funds we currently offer.

Once we’ve made the change, you’ll see some new fund options in your online account. So, if you’re not happy with the level of risk of your investment, you’ll be able to switch to a different fund at any time, and we won’t charge you to do so. We’ll let you know more about these changes nearer the time.

If you have any questions, just give us a call.

You have a choice of two funds

Global Equity

For more adventurous long-term investors

Global Equity invests in company shares.

When deciding which shares to buy, Global Equity takes into account how sustainable companies' business models are and what they're doing to lessen their negative impact on the environment.

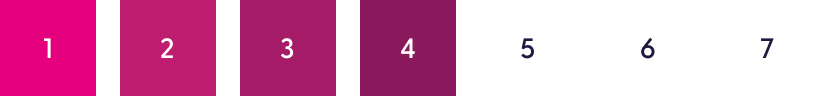

Risk rating

Lower

Higher

Lower

Higher

You can find out more about Global Equity in our Key Information Document and Fund Factsheet

Despite having an investment focus on the climate, we've chosen not to apply for a UK Sustainable Investment Label for this fund.

Global Mixed

For more cautious long-term investors

Global Mixed invests at least 65% of your money into lower risk, fixed-interest assets, which makes this fund a more cautious investment option compared to Global Equity. This element of the fund doesn’t use Global Equity's climate-focused criteria.

Up to 35% of this fund invests in climate-focused company shares via the Global Equity fund.

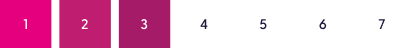

Risk rating

Lower

Higher

Lower

Higher

You can find out more about Global Mixed in our Key Information Document and Fund Factsheet

Find out more about our climate investments

Are you looking to transfer an existing help to buy ISA or lifetime ISA to OneFamily?

Lifetime ISA rules

If you take money out of your lifetime ISA without following these rules, you’ll be charged a 25% government penalty, which may mean you get back less than you pay in.

*Compared to cash lifetime ISAs, which grow your money with interest rates. As with all investing, the value can go up and down and you could get back less than you’ve paid in.