How our Global Equity fund chooses where to invest your money

Global Equity, our climate-focused fund, buys shares in companies that rank highest in our climate scoring system.

This scores companies based on things like how much work they're doing to reduce their impact on the environment and how ready they are for climate change.

We then compare companies' climate scores to others in their industry.

This rewards and supports businesses that are working towards reducing their impact on the environment. It also gives other companies another reason to choose sustainable ways to run their business - doing so will increase the likelihood that this fund will invest in them.

Up to 35% of our Global Mixed fund also invests in company shares via the Global Equity fund, with the remaining 65% invested in lower-risk, fixed-interest assets. You can choose to put your money in either Global Equity or Global Mixed.

Our starting point: the MSCI World Index

When you open our Stocks and Shares ISA or Lifetime ISA and choose to invest in our Global Equity fund, your money is used to buy shares in around 500 - 600 companies. These are chosen from over 1,600 of the world’s largest firms in an index called the Morgan Stanley Capital International (MSCI) World Index.

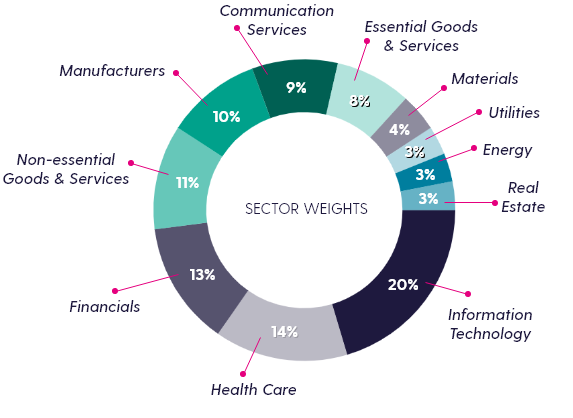

The MSCI World Index is used as a common benchmark for global stocks and shares funds, the companies that make up this index come from a wide range of different industries.

The below chart shows the breakdown of industries that make up the MSCI World Index.

Excluding companies that don't share our core values

The Ten Principles of the United Nations Global Compact asks companies to embrace and support a set of core values in the areas of human rights, labour standards, the environment and anti-corruption.

Any companies that have been found to violate these principles are excluded from the list of companies we invest in, as are companies who are involved in controversial weapons. We also won’t invest if a company’s revenues come from 10% or above on thermal coal extraction, arctic oil and gas exploration or oil sands.

We also pay close attention to the Swedish National Pension Funds’ Council on Ethics, which aims to influence companies globally to consider the environment and ethics in the way they operate.

The Council publishes a list of companies excluded based on their poor environmental and ethical behaviours.

Ranking companies on their climate credentials

To reach the standards we are hoping for, each organisation is ranked on 5 different factors:

Carbon intensity

Greenhouse gas emissions that the company has direct or indirect control over, for example greenhouse gas emissions produced by suppliers.

Fund target: 60-80% lower carbon intensity than the average score of the 1,600+ companies on the MSCI World Index.

Brown revenues

The proportion of money the company makes that comes from "brown" sectors, which are high greenhouse gas and carbon emitting industries, as classified by Trucost.

Fund target: 90% less brown revenue activity than the average of the 1,600+ companies on the MSCI World Index.

Fossil fuel reserves

The amount of fossil fuels that the company owns, including reserves that are not yet mined.

Fund target: Invest in companies that overall have 90% less fossil fuel reserves than the average of the 1,600+ companies on the MSCI World Index.

Green Revenue

How much of the money the company makes that comes from "green revenue" activities, which are things like low-carbon technology products/business as classified by FTSE Russel system.

Fund target: 300% more green revenue activity than the average of the 1,600+ companies on the MSCI World Index.

How ready the company is for climate change

How prepared the company is for climate change, taking into account any risk and mitigation plans and each company's position on climate change.

The more focused on a greener future, the better.

Fund target: A score of 0.25 or over in climate change preparedness (adaptation score).

For each of the factors above, we select the highest scoring companies within their industry. Investing across different industry sectors gives your investment portfolio the best chance to make returns and to have a positive impact on the environment. However, this isn't guaranteed and your investment can go down as well as up.

Companies must keep striving to be sustainable too, as they are reassessed four times a year. Those who don’t continue to meet our standards may leave while those who become more aligned to the five factors might find themselves included.

Let’s take two car manufacturers as an example

Car Manufacturer A: makes electric vehicles and produces clean energy

- Relatively low carbon intensity

- Zero brown revenues and fossil fuel reserves

- 100% green revenues and

- Strong adaptation score

Car Manufacturer B: known mainly as a manufacturer of automobiles, motorcycles, and power equipment

- Higher carbon intensity

- Zero brown revenues and fossil fuel reserves

- Very low proportion of green revenues

- Relatively good adaptation score

Carbon Intensity |

Brown Revenues |

Fossil Fuel Reserves |

Green Revenues |

Adaptation Score |

|

| Car Manufacturer A | 56 | 0.00% | 0 | 100.00% | 0.729 |

| Car Manufacturer B | 83.4 | 0.00% | 0 | 3.60% | 0.646 |

| Car Manufacturer A | Car Manufacturer B | |

Carbon Intensity |

56 | 83.4 |

Brown Revenues |

0.00% | 0.00% |

Fossil Fuel Reserves |

0 | 0 |

Green Revenues |

100.00% | 3.60% |

Adaptation Score |

0.729 | 0.646 |

Why we invest in Car Manufacturer A and not Car Manufacturer B

Car Manufacturer B isn't doing too badly, and it looks like it's moving towards green revenues, but isn't thriving in a sustainable fashion like Car Manufacturer A. 100% of Car Manufacturer A’s revenues come from green business activities, while only 3.6% of Car Manufacturer B’s revenue does.

As a result, we don’t invest in Car Manufacturer B at the moment but we do invest in Car Manufacturer A.

Of course, this could all change. We reassess companies' climate credentials regularly so if Car Manufacturer A changes their approach and becomes less sustainable they could lose our investment. But Car Manufacturer B also has the option to change and could still win our investment in the future

Why does it matter to us?

At OneFamily we believe that finance isn’t just personal. Every decision we make affects the people we care about most, our communities and the world. That’s why we believe in creating products that do good.

As well as reducing waste in our offices, undertaking energy-saving initiatives and using renewable energy where we can, we also offer our customers the option to invest in a fund that takes into account the climate credentials of the companies it buys shares in.

Because we're owned by our customers, we are free to focus on reinvesting our profits for their benefit, not shareholders.

We provide Young Person's Education Grants and we've created meaningful, long-term partnerships with charities that are making a positive difference locally.

Investing with a focus on the environment at OneFamily

You may also be interested in:

A beginner’s guide to ethical saving and investing

Whether you save in cash or invest in stocks and shares, where your money goes should reflect what your values are.

Is it better to save or invest your money?

If you save money in a savings account, it will grow with interest rates. Money invested in an investment fund buys shares in the stock market.

How does the annual ISA allowance work?

You can put up to £20,000 in ISAs in your name each tax year. This limit is set by HMRC and reviewed each year.

Holding your nerve when your investment loses value

Turbulent markets can affect the value of your stocks and shares ISA, but the worst thing you can do is panic.