Over 2 million members

have invested in their future with OneFamily

What is a Junior ISA?

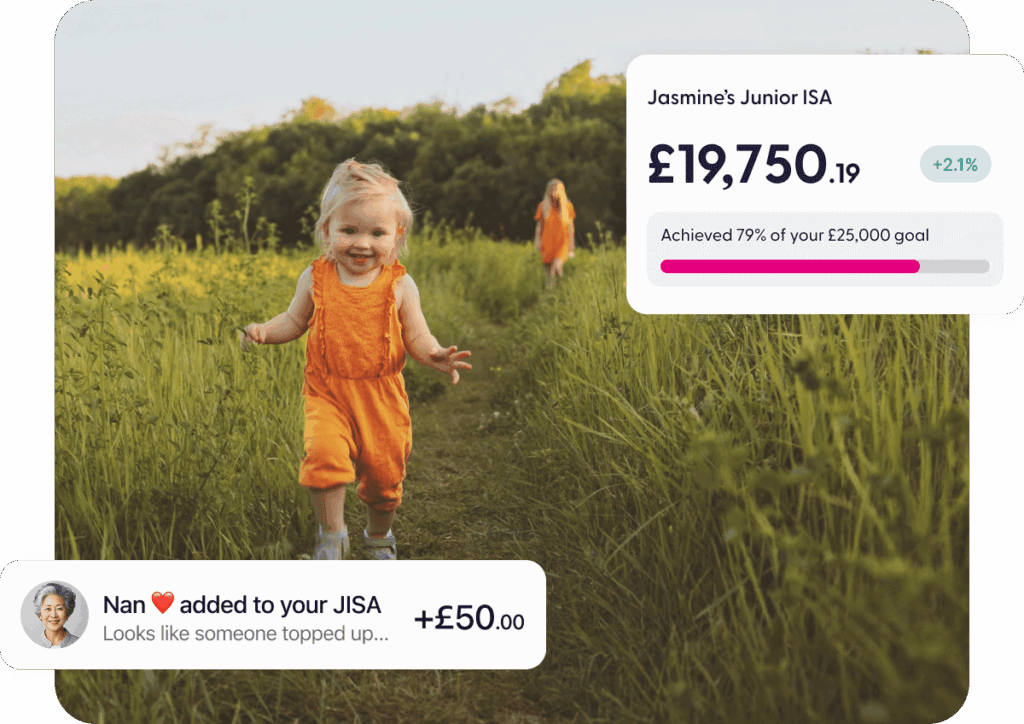

OneFamily's Junior ISA is an investment account designed to help you give your child a financial boost when they need it most: at the start of adulthood. They'll be able to access the money from the age of 18.

How much could you help your child save?

Decide how much you want to open your Junior ISA with and how much you’d like to pay in each month. Our simple calculator will quickly give you an idea of how your child’s money could grow.

Please note: No more than £9,000 may be invested into a Junior ISA within a single tax year. This includes your initial investment and your monthly direct debit payments.

The projection shows how your child's Junior ISA could grow with medium performance. Remember, projections are not a guarantee of future performance and your child could get back less than you pay in.

Your investment options

We offer three investment styles which give you the freedom to invest your money in a way that’s rewarding and comfortable for you.

Cautious

Aims for modest growth with more investment in lower-risk assets

Balanced

Aims for more growth with more investment in higher-risk assets

Adventurous

Aims to maximise growth with a focus on higher-risk assets

Start investing today – transfer to our Junior ISA

Transfer a junior ISA or Child Trust Fund to OneFamily

We don’t charge you to transfer an existing junior ISA or Child Trust Fund.

Simply let us know that you’d like to transfer an existing account to us and we’ll speak to your current provider and do the rest.

Why choose OneFamily?

Open your OneFamily Junior ISA today

Invest up to £9,000 each tax year on your child’s behalf, tax free, on top of your own £20,000 ISA allowance.